7+ loan decisioning

Our credit decisioning software and technology is designed to deliver fast reliable insights to help expedite credit decisions. Prequalification instant decisioning Prequalify customers for credit in real time at the.

How To Make Accurate Credit Decisions On Loan Applications In 30 Seconds Youtube

Loan decisioning is a multi-stage process that is increasingly being automated in order to improve efficiency and reduce portfolio risk.

. Check your eligibility for a low money down loan. Ad Compare First Time Home Buyer Lender Reviews Based On Whats Important To You. 697 of loan applications were reviewed manually while just 303 are reviewed via auto-decisioning.

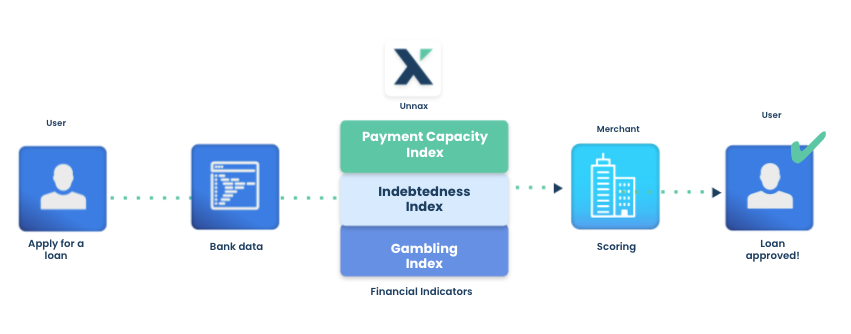

Underwrites a loan in 7 seconds. How Automated Loan Decisioning Works. Loan decisioning software APIs can pull relevant data from third parties in a matter of minutes.

With an appropriate balance of technology and human. Prequalify Leads and Process Loan Applications Instantly. Our tools and products help you drive revenue by increasing the.

Ad Getting Started is Easy. When a new loan application is submitted. The Bottom Line.

Ad One Low Monthly Payment. Well Match With an FHA Lender in Your Area Today. The Decipher platform helps determine an applications status.

The application is sent to the quality control. Modellica GDS Links full credit lifecycle solution reduces wasted marketing dollars by prequalifying incoming loan. Rated 1 by Top Consumer Reviews.

Moodys Analytics credit assessment and origination products cover all the steps involved in making faster better informed credit decisions through a holistic and. When lenders automate gathering. Since lending is highly regulated the quality check stage of the loan origination process is critical to lenders.

Automated decisioning is on the rise but it is not yet the dominant decisioning method. Our Certified Debt Counselors Help You Achieve Financial Freedom. Find A Lender That Offers Great Service.

Apply for a Consultation. AFCC BBB A Accredited. In addition the software solution automates the entire auto loan decisioning process.

This proprietary Loan Integrity AI validates and verifies data to assist in the complex decisioning process typically performed by the Underwriter. Home prices could fall by as much as 20 in 2023 0412 The average interest rate on a typical 30-year mortgage surpassed 7 this week the highest level. 6 Quality Check.

Lendsys is an automated loan decisioning software platform. The automation built-in to the Lendsys platform was designed to free savvy lenders in any market segment. When members completed loan applications at their local credit.

Loan decisioning is an art with human intervention and it relies on the skills of approving officers says LeCorgne. Underwriting loans has been becoming a faster and smoother process even before technology brought us auto-decisioning. Gather inferred data from third parties.

SBAs most common loan program which includes financial help for businesses with special requirements. An automated loan decisioning system works by providing a series of questions that allows the lender to determine whether or not they can. Compare More Than Just Rates.

Aided by an engine equipped with automated decision making lenders can process hundreds of digital loan applications daily while managing risk in real-time. But in order to make. FHA loans make home buying affortable.

Drive intelligent lending outcomes and automate your processes with Experians loan origination software.

Kaiserslautern American August 19 2022 By Advantipro Gmbh Issuu

How To Make Accurate Credit Decisions On Loan Applications In 30 Seconds Youtube

How Loan Decisioning Works Infinity Enterprise Lending Systems

Find The Right App Microsoft Appsource

Trade Lifecycle Data Warehouse With Business Intelligence Luxoft

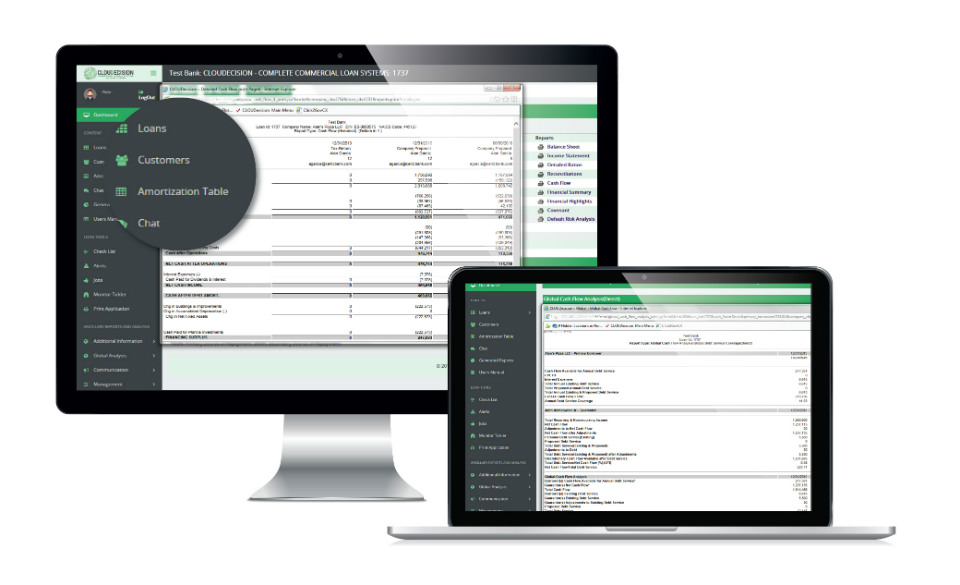

Marketplace Lending Instant Decisioning Cloudecision

Decisioning How Lenders Can Make Accurate Credit Decisions

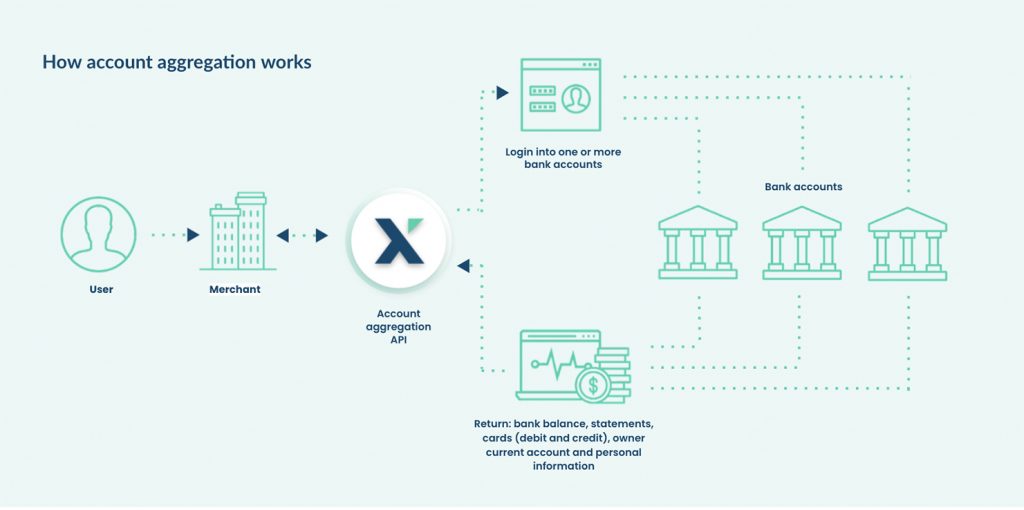

Credit Decisioning As A Service How Does Algoan Leverage Open Banking To Serve The Credit Industry By Youness Bounif Algoan Medium

46 6 Network Recruiting Platforms

Pdf An Evaluation Of Micro Finance Programmes In Kenya As Supported Through The Dutch Co Financing Programme Otto Hospes Academia Edu

Decisioning How Lenders Can Make Accurate Credit Decisions

Loans Management Systems Third Pillar

Decisioning How Lenders Can Make Accurate Credit Decisions

Ex 99 2

Commercial Lending Resume Samples Velvet Jobs

Kaiserslautern American May 7 2021 By Advantipro Gmbh Issuu

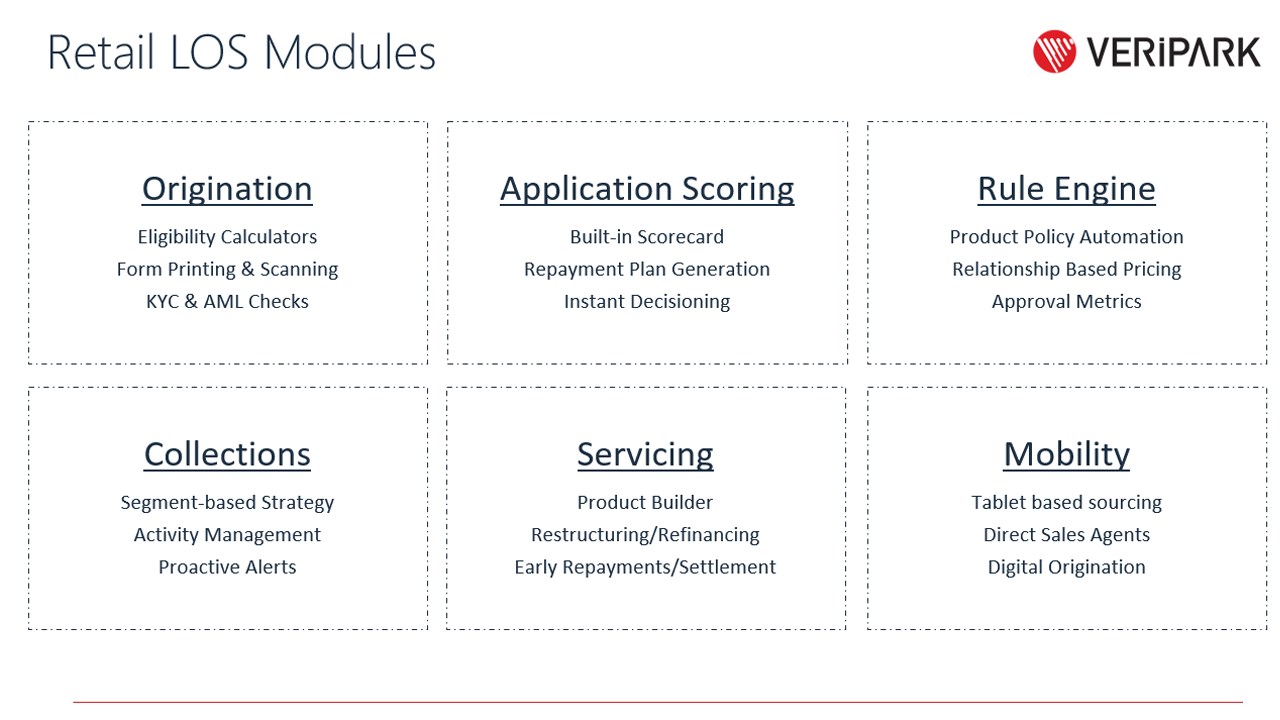

Digital Lending Veripark